The real estate and economic landscape in June brought a wave of cautiously optimistic news—promising signs that momentum is shifting in a positive direction, though challenges still linger. Here’s what Bay Area buyers, sellers, and real estate professionals need to know.

✅ Consumer Prices Cool Off – A Welcome Sign for Inflation

Inflation took a softer turn in May, with the Consumer Price Index (CPI) rising 2.4% year-over-year—exactly in line with economists’ expectations. Notably, core CPI (excluding food and energy) came in slightly lower than forecasted at 2.8%.

Energy prices fell by 1%, helping to offset increases in other categories such as food and shelter.

Shelter costs rose just 0.2% month-over-month, the smallest increase since November 2021.

The lower inflation figures were driven in part by decreases in new and used car prices, which dropped by 0.3% and 0.5%, respectively. While this is good news in the short term, big-name retailers have already signaled potential price hikes this summer, so the reprieve may be temporary.

📈 Small Business Optimism Rises for the First Time in 5 Months

The NFIB Small Business Optimism Index jumped three points in May to 98.8, climbing back above the long-term average. This marks the first increase since December 2024 and reflects renewed confidence, particularly after U.S.–China trade tensions eased in mid-May.

25% of small business owners now expect better business conditions ahead.

Expectations for inflation-adjusted sales also rose, indicating a more hopeful economic outlook.

However, it’s not all clear skies. The uncertainty index ticked up again, and inventory shortages are beginning to creep in, possibly foreshadowing supply chain issues and pricing pressure in certain markets.

👷 Labor Market Outlook Improves as Household Sentiment Rebounds

Data from the New York Fed’s Survey of Consumer Expectations points to easing concerns over job security and a brighter financial outlook for U.S. households.

The likelihood of job loss dropped to 14.8%.

The perceived chance of finding a new job if laid off increased to 50.7%.

Earnings expectations rose to 2.7% year-over-year, while fewer households expect their finances to worsen over the next year.

These trends suggest a more stable labor environment—good news for both homebuyers and renters evaluating long-term affordability and stability.

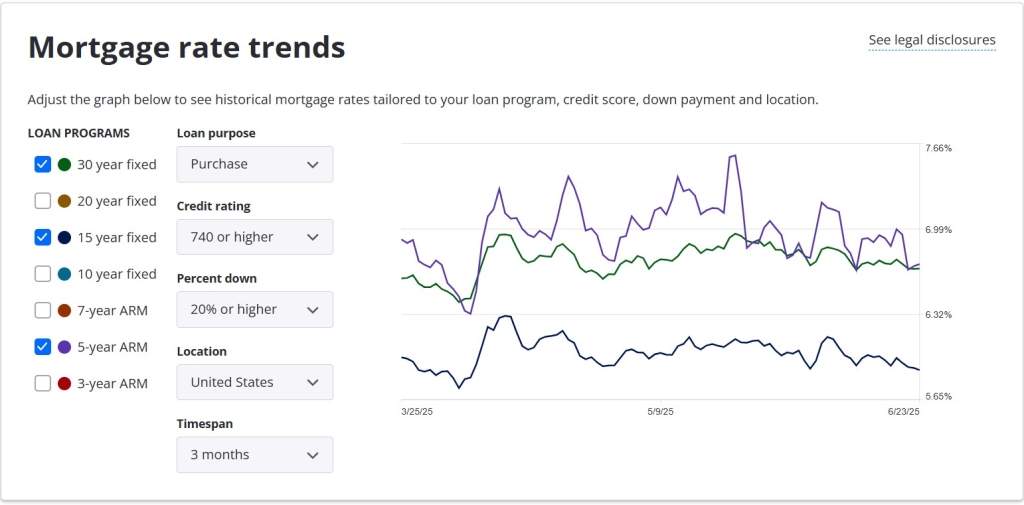

🏠 Mortgage Rates Hit a Monthly Low

Thanks to May’s softer inflation numbers, mortgage rates dipped to their lowest point in a month by mid-June, according to Mortgage News Daily.

The average 30-year fixed mortgage rate fell by 0.08% from the previous week.

U.S. Treasury yields dropped midweek as inflation metrics came in below expectations.

However, rising geopolitical tensions—particularly in the Middle East—pushed yields slightly higher by week’s end, hinting at continued rate volatility. Buyers may still find opportunities to lock in favorable rates, but should remain vigilant in the weeks ahead.

⚠️ Foreclosure Activity Dips Amid Resilient Job Market

According to ATTOM, foreclosure filings declined by 1.5% from April to May, showing that the job market is doing its part to keep homeowners afloat.

35,498 U.S. properties had foreclosure filings in May, still up 9.8% year-over-year.

In California, one in every 3,515 homes faced foreclosure, with Lake, Plumas, and Shasta Counties experiencing the highest rates.

Despite rising home prices and affordability concerns, the strong labor market is preventing a sharp increase in foreclosures—for now.

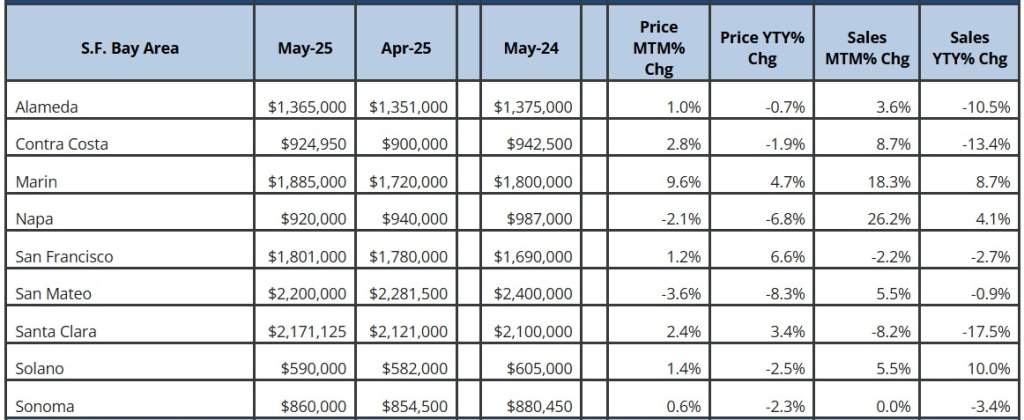

🏡 What This Means for Bay Area Buyers and Sellers

The Bay Area market, like the broader U.S. economy, is showing signs of improvement—but we’re not in the clear yet. Here’s our take:

Buyers: If you’ve been waiting for mortgage rates to drop, now might be a good time to make a move before geopolitical uncertainties send rates higher again.

Sellers: A more confident consumer base and steady job market could keep demand strong, especially for well-priced and move-in-ready homes.

📍Final Thoughts from The Cal Agents

While the road ahead isn’t without its bumps, June’s data brought welcome signs of relief—from cooling inflation to more stable employment expectations. If you’re planning your next real estate move, The Cal Agents are here to help you navigate the evolving market with expert advice and local insight.

📞 Let’s talk: www.thecalagents.com