The Federal Reserve’s much-anticipated rate cut is finally here, and it’s sending ripples through the housing market. With the Fed lowering interest rates by 50 basis points (bps) for the first time since 2020, both homebuyers and sellers are watching closely to see how mortgage rates will react in the coming months.

The September real estate market shows both challenges and opportunities as consumers navigate a cooling market with potential renewed interest in home buying.

Fed Slashes Interest Rates: A Boost for Buyers?

Last week, the Fed announced a 50-bps rate cut, marking the first reduction in interest rates in four years. While mortgage rates remained largely unchanged immediately after the announcement, they remain near their lowest levels in two years. This could be a game-changer for homebuyers looking to secure favorable financing before the end of the year.

As seen in the Mortgage Rate Trends graph below, 30-year and 15-year fixed rates have trended downward in recent months. While rates did not drop sharply after the Fed’s announcement, there’s optimism that continued rate cuts may lead to lower borrowing costs, encouraging more buyers to enter the market in the months ahead.

Housing Sales and Prices: A Cooling Market

Despite favorable mortgage rates, housing sales have taken a step back as many buyers adopt a “wait and see” approach. Closed sales for single-family homes in California dipped 6.3% in August compared to July, even though sales were up 2.8% year-over-year (YoY). Buyers appear to be waiting for further clarity on interest rates and inflation before making any major moves.

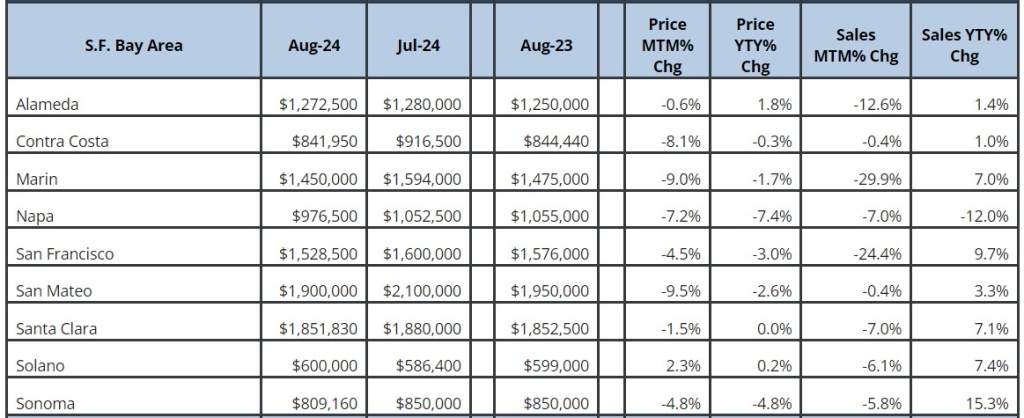

On the pricing front, the median home price in California continued its modest growth, posting a 3.4% YoY increase. However, the growth rate was the smallest in nearly a year, and on a month-to-month basis, prices inched up only 0.2%—the smallest July-to-August increase since 2008. In the Bay Area specifically, we’re seeing more volatility across counties, with price declines in several areas.

For example, Marin County saw a significant 9% decrease in home prices from July to August 2024, while Contra Costa County experienced an 8.1% dip during the same period. Meanwhile, Solano County managed to buck the trend with a slight 2.3% price increase.

Here’s a detailed breakdown of how prices and sales performed in key Bay Area counties in August:

Outlook for the Bay Area Housing Market

While we’re seeing a short-term slowdown in housing activity, the Fed’s rate cut signals that better borrowing conditions may be on the horizon. With more rate cuts potentially on the way and mortgage rates hovering near multi-year lows, the Bay Area could see a surge in homebuying activity as we head into the fall.

Sellers, on the other hand, should be prepared to adjust their pricing strategies as the market cools. Homes that are priced competitively are likely to attract more interest as buyers begin to re-enter the market.

Conclusion: Making the Most of Market Opportunities

The Bay Area housing market is in a transitional phase, with the recent Fed rate cut and cooling price growth creating both challenges and opportunities. Buyers who have been on the sidelines may soon find the perfect moment to enter the market, while sellers will need to stay agile in a shifting landscape.

If you’re considering buying or selling in the Bay Area, now is the time to get expert guidance. The Cal Agents are here to help you navigate these evolving conditions and make informed decisions that align with your real estate goals. Reach out today to discuss your next steps!