Southern California Wildfires Impact the Broader Market

The start of 2025 has been marked by devastating wildfires in Southern California, ravaging parts of L.A. County. With over 10,000 structures destroyed and nearly 180,000 people evacuated, the fallout from these fires is expected to significantly impact the local housing market. While the situation is improving slowly, the fires already have far-reaching consequences.

For the Emeryville real estate market, this disruption has broader implications. Although the immediate effects are not as severe as in L.A. County, the aftermath of these fires is expected to create a ripple effect throughout California. Housing supply in affected areas will tighten, possibly pushing demand higher in nearby regions like Emeryville. As housing demand recovers, home prices in these surrounding areas, including Emeryville, could experience upward pressure in 2025 once the market stabilizes.

Mortgage Rates: A Key Factor for Homebuyers

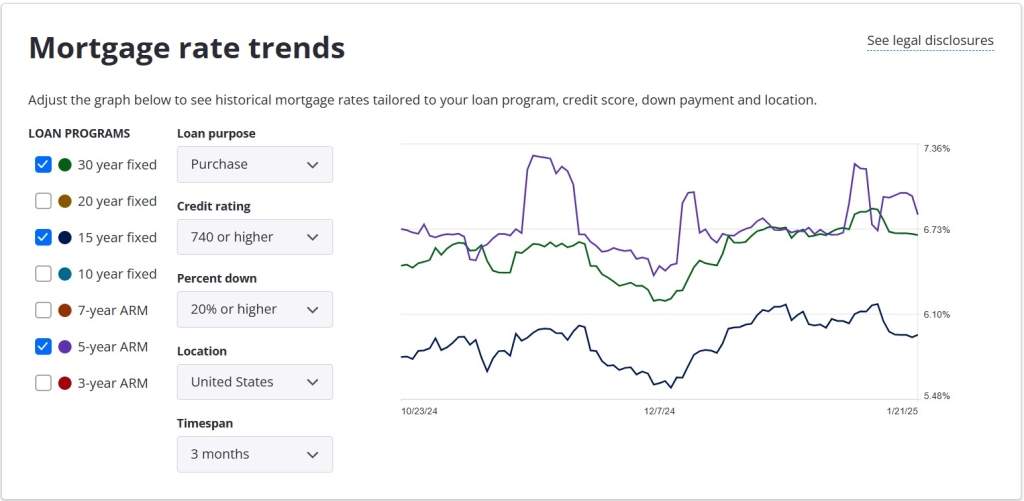

The December job report directly impacted mortgage rates, which climbed to 7.26% for the average 30-year fixed mortgage. With mortgage rates expected to remain volatile throughout the year, homebuyers in Emeryville may face a more challenging environment. However, given the region’s appeal and the proximity to major employers, the demand for homes will likely persist.

As rates continue to fluctuate, potential buyers in Emeryville may consider alternatives like adjustable-rate mortgages (ARMs), which have shown more favorable trends. The 5-year ARM, for example, has been fluctuating in recent months but remains a viable option for those seeking more affordable rates in the short term.

Inflation and Consumer Expectations

In December, consumer expectations about inflation remained steady at 3.0% for the short term. Despite concerns about the broader economic outlook, consumers are still optimistic about home price increases, expecting a 3.1% rise next year. This outlook could influence homebuyers in Emeryville, who are increasingly seeking stability and growth potential in their investments.

However, the likelihood of job loss has decreased slightly, which may indicate a growing sense of security among residents. This could further support housing demand as people become more confident in their financial situations and willing to invest in real estate.

Emeryville Real Estate Market: December 2024 Performance

Looking at the specific performance of the Emeryville real estate market in December 2024, the area showed promising resilience, maintaining its position as a strong and desirable location despite the fluctuating trends seen in the broader San Francisco Bay Area.

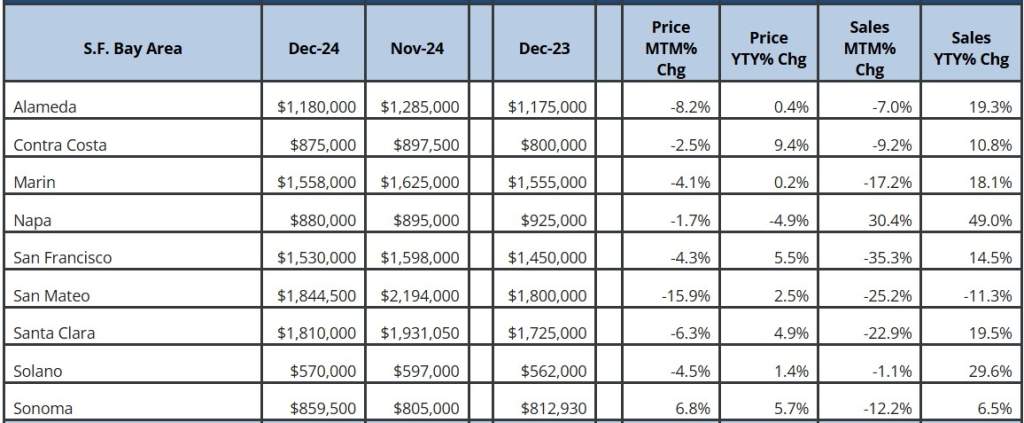

Throughout December, Emeryville’s home prices remained relatively stable, with slight fluctuations that were consistent with market patterns across the region. However, while prices held steady, the sales volume experienced some changes, reflecting the wider market dynamics. For instance, areas like Alameda saw a notable price drop of 8.2% compared to the previous month, while others like Sonoma experienced price growth, reflecting the volatile nature of certain local markets within the Bay Area.

Price and Sales Volume in Emeryville

- Home Prices: In Emeryville, home prices did not experience the sharp declines observed in other Bay Area cities like San Mateo, where prices dropped 15.9% month-over-month in December. While the city’s real estate performance remained stable, sales volume fluctuated, which was in line with regional trends. This is characteristic of a market that is stabilizing after a period of volatility caused by rising mortgage rates and shifts in consumer sentiment.

- Sales Volume: As the broader market saw sales volumes decline, particularly in cities like San Francisco, where sales were down by 35.3% year-over-year, Emeryville showed resilience, with sales volume not dipping as dramatically. The consistent demand, however, was not immune to the overall shifts within the market, particularly as mortgage rates continued to fluctuate and affect affordability.

Looking Ahead: Spring 2025 Outlook for Emeryville

Despite the modest fluctuations seen in December 2024, the outlook for Emeryville real estate in spring 2025 is promising. Several factors contribute to the positive expectation:

- Job Growth and Economic Stability: With strong employment growth across the Bay Area, including key industries like technology, healthcare, and hospitality, Emeryville stands to benefit from its proximity to San Francisco and Oakland. As more workers return to the job market and incomes rise, the demand for housing will continue to grow, even as mortgage rates stabilize or potentially decrease.

- Tight Housing Supply in Surrounding Areas: One of the key drivers of the Emeryville real estate market is the tight housing supply in nearby cities like Oakland and San Francisco. With rising prices and limited inventory, buyers who are priced out of these areas will increasingly turn to Emeryville, where housing remains relatively more affordable compared to its neighbors.

- Rental Demand: As Emeryville continues to be a hub for both renters and potential buyers, the demand for rental units will also remain strong. The market dynamics of higher demand and limited inventory in neighboring areas will keep rental prices in Emeryville stable or even increase, offering property owners a good return on investment.

- Development and Redevelopment Projects: Emeryville’s several ongoing and upcoming developments are expected to boost the market. As the city continues to attract tech and creative industry professionals, new residential and mixed-use projects are expected to support housing demand.

Conclusion: What’s Next for Emeryville?

As we move into 2025, the Emeryville real estate market is poised to experience recovery and growth. While the challenges posed by rising mortgage rates and recent housing sentiment dips cannot be ignored, the region’s fundamental strength, fueled by job growth and ongoing demand for housing, will continue to support its real estate market. For buyers and sellers alike, keeping a close eye on interest rates and economic trends will be key to navigating the year ahead.