As we step into 2025, the U.S. economy presents a mixed picture, balancing strengths and challenges. While some economic indicators signal potential slowdowns, others suggest resilience and stability. Retail sales have shown a temporary pullback, inflation remains a topic of concern, and small business optimism has slightly declined. However, consumer fundamentals remain strong, and construction spending continues to show positive signs. One thing is clear: uncertainty will define the year ahead as markets and policymakers navigate shifting economic dynamics.

Retail Sales: A Temporary Dip After a Strong Year-End

Following a robust holiday shopping season in 2024, U.S. retail sales experienced a notable decline in January, dropping 0.9% from the previous month. This dip, the largest in nearly two years, exceeded expectations and was observed across multiple retail categories. However, rather than signaling a downturn, this pullback may reflect a natural recalibration after a period of strong consumer spending. December’s retail figures were revised upward, showing sustained consumer activity through the final months of 2024. With January’s sales still reflecting a 4.2% year-over-year increase, a rebound in consumer spending over the next few months remains a distinct possibility.

Inflation: A Complex Picture

Inflation remains a pressing concern as the Consumer Price Index (CPI) recorded a 0.5% increase in January, bringing annual inflation to 3.0%. This marks the fourth consecutive month of rising prices, driven by increases in shelter costs and auto insurance premiums. However, the Producer Price Index (PPI), which tracks wholesale prices, suggests that inflationary pressures may be moderating. While January’s PPI was slightly higher than expected, easing costs in key areas like healthcare and domestic airfare indicate potential relief in the near future. Analysts predict that the Fed’s preferred inflation measure, the personal consumption-expenditure index (PCE), will align more closely with the central bank’s targets in the coming months.

Small Business Sentiment: Cautious Optimism Amid Policy Uncertainty

The NFIB Small Business Optimism Index saw its first decline in five months, slipping to 102.8 in January. Despite this dip, optimism remains above the four-year average and well above the historical benchmark of 98. Notably, the Uncertainty Index surged by 14 points to 100, the third-highest reading on record. This increase suggests that recent policy changes, including potential tariffs, are creating concerns for business owners. Additionally, expectations for economic improvement declined, and fewer business owners saw the current climate as an ideal time to expand. With further policy announcements on tax cuts and regulations expected throughout 2025, fluctuations in small business sentiment are likely.

Labor Market and Consumer Confidence: A Mixed Sentiment

The New York Fed’s Survey of Consumer Expectations reflects divided views on job security and future financial well-being. The probability of job loss increased to 14.2%, but optimism about finding new employment also rose to 51.5%. Additionally, consumers anticipate a modest 3% growth in earnings over the next year. Household spending expectations have softened, with projected increases dropping to 4.4%, the lowest level since 2021. More consumers foresee financial difficulties in the coming year, with 21% expecting their financial situation to worsen, up from 19.9% in December. These mixed signals highlight the uncertainty that will shape economic behavior in 2025.

Construction Spending: Encouraging Signs for Residential Development

Construction spending ended 2024 on a high note, growing 6.5% year-over-year to $2.15 trillion. Residential construction, particularly single-family homes, demonstrated strength, rising 1.5% from the previous month. However, the multifamily sector showed continued weakness, declining by 0.3% in December and 10.5% year-over-year. With single-family housing starts and permits rebounding late last year, residential construction is expected to remain stable in early 2025. Conversely, multifamily construction may continue to struggle in the first half of the year.

Looking Ahead: Navigating an Uncertain Economic Landscape

While early economic data for 2025 presents some challenges, the broader picture remains one of resilience. Consumer spending fundamentals are solid, inflation may be moderating, and construction activity remains strong in key areas. However, uncertainty—driven by policy changes, labor market shifts, and global economic conditions—will be a defining theme this year. As we move forward, staying informed and adaptable will be key to navigating the evolving economic landscape.

Final Thoughts

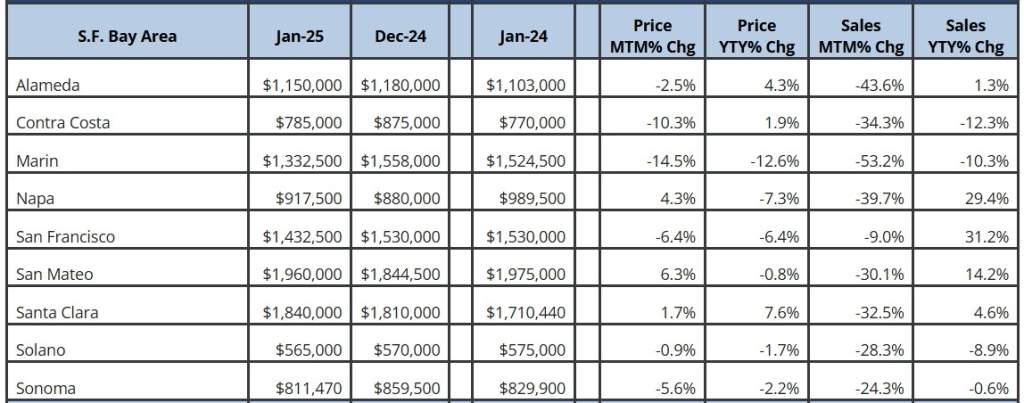

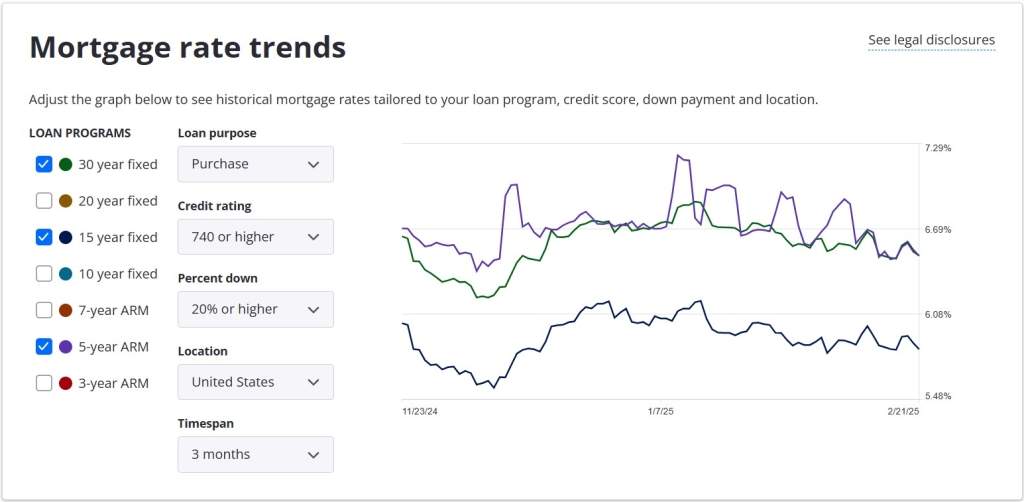

The San Francisco Bay Area housing market remains dynamic, with changing price trends and mortgage rates influencing buyer and seller decisions. If you’re considering buying or selling a home, working with a knowledgeable real estate professional can help you navigate these trends and make the best decision for your situation.