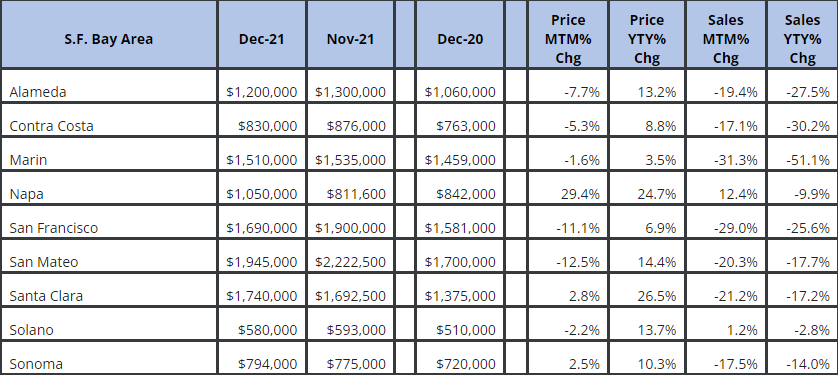

The December 2021 housing data may seem alarming at first glance. Month-on-month price and sales volumes changes are both negative, while year-to-year sales even recorded a 10% to 51% decrease in most counties.

Are the Bay Area Real Estate Buyers withdrawing from the market?

Fortunately, the answer is no. The decrease in sales volume is driven by a lack of inventory. In December 2020, there was a 1.1 month of inventory, whereas, in Dec 2021, there were only 0.8 months. With 27% fewer homes on the market for sale, it is no surprise that sales volume decreased.

January FOMC Meeting

In January’s FOMC meeting, inflation risk took center stage. Fed Chairman Jerome Powell signaled that the first interest rate hike in 2022 will come in March. The shrinkage of the Fed’s balance sheet will take longer.

What does this all mean?

Historically, the Fed uses Federal Funds Rate as the primary means to control the amount of money in circulation. By raising the Federal Funds Rate, the FED increases borrowing costs. Thus, banks are encouraged to keep more money in reserve rather than lending it out.

Learnings from 2008

To fight the subprime mortgage crisis of 2008, the Fed lowered the Rate to 0.08% to stimulate the economy.

However, this proved to be insufficient to increase the banks’ willingness to put money in circulation. The Fed then borrowed the Quantitative Easing policy from Japan, as another tool to stimulate the economy.

In layman’s terms, QE policy is all about the central bank injecting money into the economy by buying government bonds. Money injection increases the money supply (“easy money”). Banks will lend more, consumers will spend more, businesses receive more and spend even more.

But before the Fed had a chance to reverse its 2008 QE policy, it faced another crisis – COVID shutdown 2020. The Fed had to keep buying even more bonds and put more money in circulation to keep economic activities going.

Too much money in circulation.

When too much money is circulating, it causes inflation. For example, when businesses have access to easy money, they will offer higher salaries to workers, even competing for them. When workers are paid more, they are more willing to spend. Then when businesses see consumers are willing to spend, they increase prices. To fight inflation, the Fed can employ the two tools described above:

- increase the Rate, and

- take money back from the economy by selling bonds it previously purchased (reversing QE)

Between these two choices, reversing QE takes time to kick in. The Fed can’t sell a huge amount of bonds in a short amount of time because it could shock the market. Increasing interest rate is a more immediate tool. Because the interest rate has been almost 0% since March 2020, the blade of this tool is dull. Unsurprisingly, in the FOMC meeting, the Fed signaled the series of rate hikes in 2022 while it gradually sell off assets on its balance sheet.

The effect on the housing market

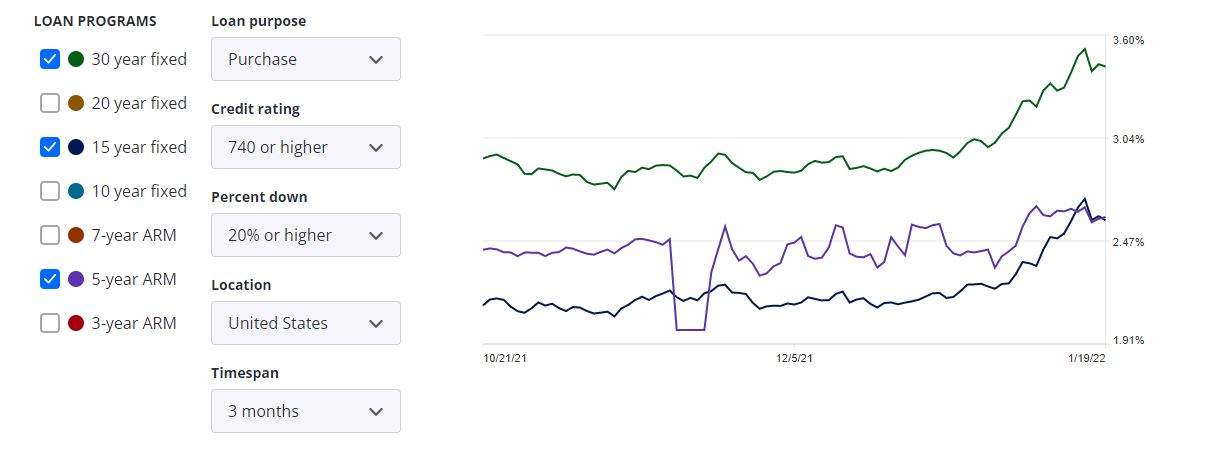

As the market anticipates a higher interest rate and the Fed sells 10-year bonds, yields will increase, causing the 30-year mortgage interest rate to go up. As you can see in the chart below, it has already gone up noticeably in Jan 2021. Mortgages become less affordable for more buyers.

On the other hand, the highly overvalued stock market is anticipated to come down substantially. Since stock holdings are Gen Z’s primary resource for a down payment, a stock market devaluation will inevitably affect the availability of funds for the purchase of homes.

The increase in monthly mortgage payments together with a decrease of down payment funding will turn away many homebuyers in the second half of 2022. You may ask, why only in the second half of 2022? I anticipate many buyers currently in the market will want to “hop on the bandwagon” of homeownership before mortgage rates go up even higher. Once this wave of buyers finishes buying, the next wave of buyers will enter the market more cautiously.

Home prices will remain stable.

On the supply of homes, I do not foresee panic sales. Many property owners took the opportunity of low-interest rates and refinanced their mortgages in 2020 and 2021. They will not be under pressure to sell in a tight-money environment. This tight supply and demand market conditions will cause home values to stay at the current price level. Small increases might happen over the next few years.

Mortage Rates Jan 2022