As we dive into the middle of 2024, the San Francisco Bay Area real estate market continues to demonstrate its dynamic nature, influenced by various economic factors, buyer behavior, and regional trends.

This market insight for June 2024 will shed light on the latest data, including housing prices, sales trends, and mortgage rates, providing valuable information for buyers, sellers, investors, and renters alike.

Bay Area Housing Market Performance

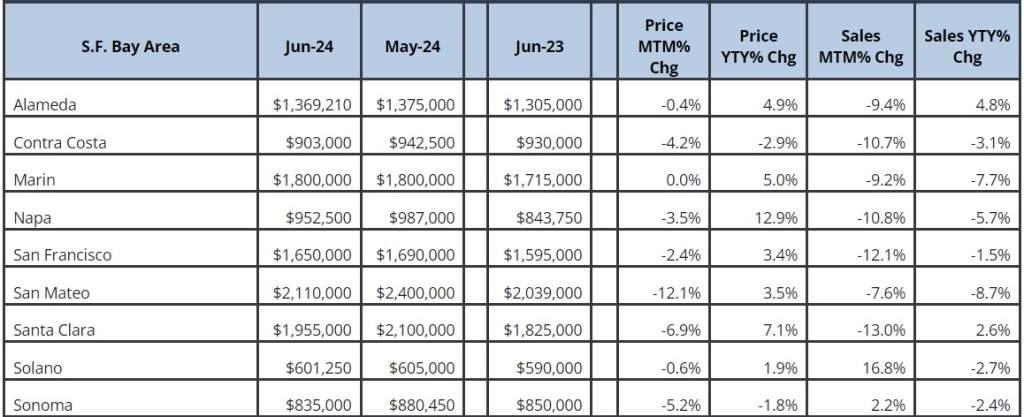

Analyzing the year-over-year (Y2Y) data for June 2024 across the Bay Area counties provides deeper insights into the market dynamics:

Price Trends

The Y2Y percentage changes in home prices demonstrate notable variations across counties. While some areas like Marin (+5.0%) and Santa Clara (+7.1%) have seen appreciable increases, other counties such as San Mateo (+3.5%) and Contra Costa (-2.9%) have experienced modest adjustments or slight declines.

The overall trend indicates a resilient market with pockets of growth, particularly in counties with strong economic fundamentals and desirable living conditions.

Notable Rises: The standout performer is Napa, with a remarkable 12.9% increase, followed by Santa Clara at 7.1%. These figures highlight areas of high demand and limited supply, where buyers are willing to pay a premium.

Sales Trends

Sales volume, a critical indicator of market health, has shown a mixed picture. Some counties like Solano (+16.8%) and Santa Clara (+2.6%) have witnessed positive sales growth, indicating robust buyer interest and market activity.

On the flip side, areas like San Francisco and Alameda have seen double-digit declines in sales volume, at -12.1% and -9.4% respectively, suggesting potential buyer hesitation due to high prices or market saturation.

Renting vs. Selling: If you’re a landlord considering selling your property, you may want to act soon if you want to take advantage of the current market conditions. Rents are still high in many areas, so you could also consider continuing to rent out your property.

Mortgage Rate Trends

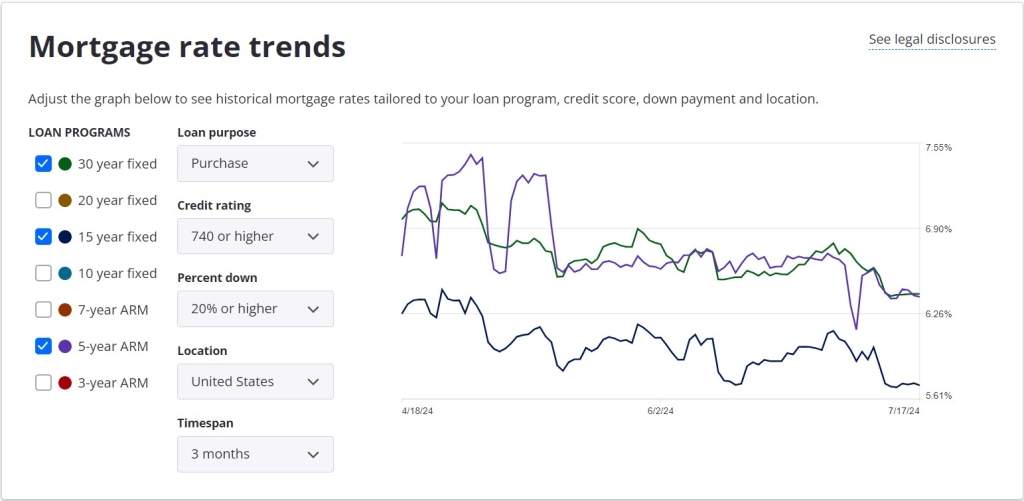

The latest data on mortgage rates reveals a diverse range of movements across different loan programs. For high-credit buyers (740 or higher) with a 20% down payment, the following trends have been observed over the past three months:

30-year fixed-rate mortgage: Rates have experienced fluctuations, settling around 6.23% by late July. This stability provides a predictable long-term option for buyers.

15-year fixed-rate mortgage: Rates have shown similar variability, now averaging approximately 5.57%. This option remains attractive for those looking to pay off their mortgage faster while enjoying lower interest costs.

5/1 ARM (Adjustable Rate Mortgage): This category has seen more significant volatility, with current rates around 7.65%. This variability can be a double-edged sword, offering lower initial rates but potential increases in the future.

Lower mortgage rates can stimulate buyer interest and increase market activity. For buyers, this means more favorable borrowing conditions. For landlords and investors, lower rates might present refinancing opportunities to reduce costs and improve cash flow.

Home Sales

June home sales in California saw a slight decline. The sales of existing single-family homes dropped to 270,200, a 0.8% decrease from May’s 272,410 and a 2.7% drop from 277,690 in June 2023.

On a year-to-date basis, home sales are down 0.5% compared to last year. Despite the fluctuation in rates, pending sales have shown signs of improvement, with average pending sales per transaction-day increasing by 8% year-over-year.

Interest Rates

Interest rates have been trending downward, a positive development for prospective homebuyers and the housing market overall. The Federal Reserve is scheduled to meet at the end of July, with many expecting a rate cut in September 2024. Treasury rates have been improving, signaling that inflation is gradually easing.

In June, inflation dropped below 3% year-over-year for the first time since the pandemic-induced price increases. This shift has led to a less inverted yield curve, suggesting that the bond market is optimistic about a potential ‘soft landing’ by the Fed. Even if rate cuts are delayed, interest rates are expected to continue their downward trend, albeit with ongoing volatility.

Inventory Expansion

A welcome development for buyers is the notable increase in active listings, up 36% year-over-year in June. New constructions are also on the rise, contributing to a broader range of choices for prospective homeowners. This trend is expected to gain momentum as market conditions stabilize and mortgage rates moderate further.

Multi-Family Housing Boom

A significant surge in multi-family housing starts, particularly new apartment units reaching a 50-year high in June, promises to alleviate pressure on the rental market and expand housing options for a wider range of residents.

Construction and Housing Starts

Housing starts showed mixed results in June. The seasonally adjusted annual rate of housing starts was 1.35 million units, a 3.0% increase from May but a 4.4% decline from June 2023. The surge in multifamily development, which started jumping 22.0% from the previous month, contributed significantly to this growth.

Conversely, single-family starts saw their fourth consecutive decline, hampered by high mortgage rates. However, with anticipated rate cuts later in the year, single-family construction is expected to improve in Q3 and Q4.

Conclusion

The San Francisco Bay Area real estate market in June 2024 is characterized by a mix of price stability and volatility, influenced by economic factors such as inflation, mortgage rates, and consumer sentiment.

As we move into the second half of the year, the potential for further rate cuts and easing inflation could provide a boost to the housing market, encouraging more buyers and sellers to participate.

For stakeholders, it is crucial to stay informed and responsive to these trends. Buyers should explore opportunities with favorable mortgage rates, sellers should adjust pricing strategies to remain competitive, and landlords should consider refinancing options to enhance cash flow.

As the market continues to evolve, staying ahead of the curve will be key to navigating the dynamic Bay Area real estate landscape.