As we move through March, economic indicators continue to send mixed signals, providing both positive and concerning insights for the months ahead. While inflation has begun to cool and retail sales have rebounded, consumer sentiment remains low, and small business optimism is faltering. Here’s a breakdown of the latest economic trends and what they could mean for the real estate market.

Inflation Moderates, Offering Relief to Consumers

Inflation showed signs of easing in February, with the Consumer Price Index (CPI) increasing by just 0.2% from the previous month and 2.8% year-over-year. This marks the first slowdown in price growth after four consecutive months of increases. The drop was largely driven by declines in energy and food prices, with gasoline prices falling 1% and grocery prices remaining stable.

The Producer Price Index (PPI) also provided encouraging news, as wholesale prices remained unchanged in February instead of rising as expected. However, some service sector prices—such as hospital care, insurance, and airfare—continue to exert upward pressure on overall inflation. While these trends indicate progress, the Federal Reserve is likely to keep a close eye on the personal consumption-expenditure index (PCE), their preferred measure of inflation, which could still come in higher than expected.

Retail Sales Rebound, But Growth Remains Tepid

After a sharp decline at the start of the year, U.S. retail sales edged up 0.2% in February, though this was below economists’ forecasted 0.6% gain. While the labor market remains strong and wages continue to grow, consumer spending is being restrained by lingering economic concerns. Declines in gasoline (-1.0%), auto sales (-0.4%), department stores (-1.7%), and restaurant spending (-1.5%) all contributed to weaker-than-expected retail sales.

Despite these figures, March spending could hold steady if labor market conditions remain favorable. However, ongoing trade disputes and economic uncertainty may pose challenges in the second quarter, potentially slowing retail growth further.

Small Business Confidence and Consumer Sentiment Decline

The NFIB Small Business Optimism Index dropped for the second consecutive month, falling to 100.7 in February. Although optimism remains above historical averages, uncertainty is rising due to concerns over tariffs, layoffs, and economic policy. Seven out of ten index components declined last month, signaling increasing caution among business owners.

Similarly, consumer sentiment has taken a hit, plunging to a 28-month low according to the University of Michigan’s Survey of Consumers. The index fell from 64.7 in February to 57.9 in March, with inflation expectations rising sharply. Short-term inflation expectations surged to 4.9%, the highest since November 2022, while long-term expectations climbed to 3.9%, marking the largest monthly increase in three decades.

What This Means for the Federal Reserve and Interest Rates

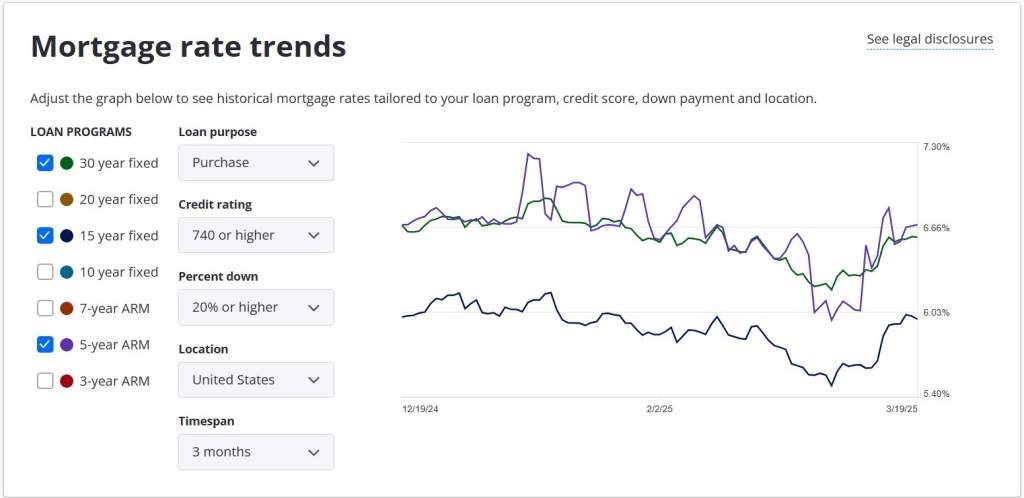

With the Federal Reserve set to meet later this week, market analysts anticipate that interest rates will remain unchanged. However, given recent inflation data, there is speculation that the Fed may consider a 25-basis-point rate cut in May if inflation continues to cool and economic growth slows.

For the housing market, stability in interest rates could provide some relief for prospective homebuyers. Lower mortgage rates in the coming months may also help sustain housing demand, despite ongoing affordability challenges.

Foreclosure Activity Rises Slightly But Remains Manageable

Foreclosure activity in the U.S. increased by 5% month-over-month in February, with 32,383 properties receiving foreclosure filings. However, filings remain 1.7% lower than last year and are significantly below the peak levels seen during the 2008 financial crisis.

The highest foreclosure rates were observed in Delaware, Illinois, Nevada, New Jersey, and South Carolina. While an uptick in foreclosure activity is expected as the market normalizes, home prices are projected to rise again in 2025. Assuming the economy avoids a recession, foreclosure levels should remain stable over the next year.

Final Thoughts

The economy is at a pivotal moment, with inflation easing but consumer and business sentiment weakening. As the Federal Reserve deliberates its next steps, real estate professionals and homebuyers should remain informed about how economic trends impact mortgage rates, home prices, and affordability. For now, cautious optimism prevails as we navigate shifting market conditions in 2025.