As we move further into 2024, the San Francisco Bay Area housing market is demonstrating its resilience amid a backdrop of fluctuating economic indicators and evolving market dynamics. May has been a month of significant activity, with diverse trends observed across the region’s counties. This comprehensive analysis provides key insights and detailed statistics to help you stay informed and navigate the complex market landscape.

Bay Area Home Prices and Sales

The real estate market in the San Francisco Bay Area continues to showcase its dynamic nature, with varying trends across different counties. Here’s a snapshot of how the market performed in May 2024:

Key Insights

- Price Appreciation: Overall, the Bay Area has seen a healthy price appreciation year-over-year (YTY), with Santa Clara and San Mateo counties leading the pack at 17.4% and 15.7% respectively. This is indicative of strong demand and limited inventory, which is a common theme in the region.

- Monthly Fluctuations: Month-to-month (MTM) changes show some volatility. For instance, San Francisco experienced a 6.1% decrease in home prices compared to April 2024, while San Mateo saw an 11.6% increase. These fluctuations could be attributed to seasonal trends, changing buyer preferences, and macroeconomic factors.

- Sales Activity: Sales activity has been robust in several counties. Notably, Marin County saw a 28.7% increase in sales from April to May 2024, while Santa Clara County reported a 12.4% rise. This suggests a strong market sentiment among buyers, possibly fueled by competitive mortgage rates and the ongoing desirability of Bay Area living.

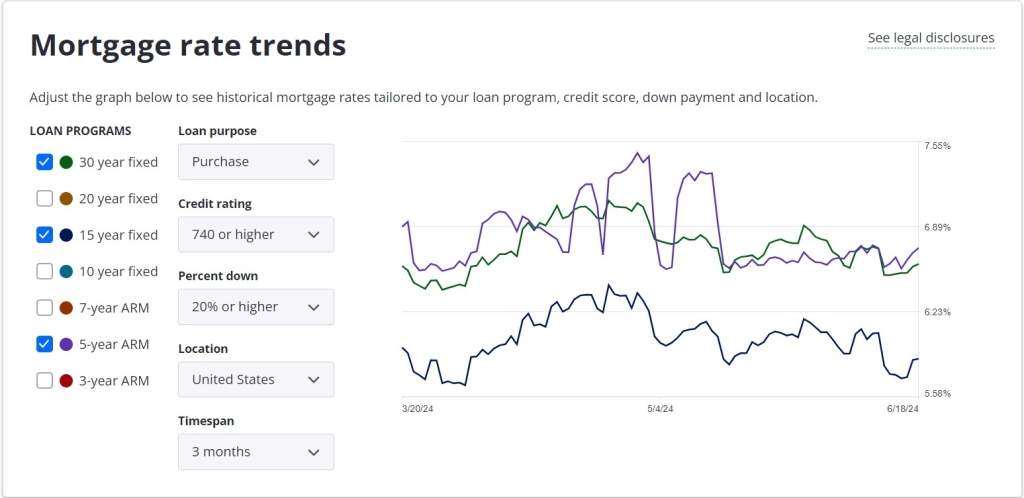

Mortgage Rate Trends: A Delicate Balance

Mortgage rates have been a critical factor for buyers and sellers alike. Over the past few weeks, mortgage rates have seen a slight increase after a period of easing. This fluctuation is closely tied to broader economic conditions, including recent reports indicating a downward trend in consumer inflation and a slowdown in retail spending.

The April Consumer Price Index (CPI) report revealed a modest 0.3% month-over-month increase and a 3.4% year-over-year rise. Notably, core inflation, excluding volatile food and energy prices, rose by 3.6% year-over-year—the slowest pace in three years. These data points suggest that the Federal Reserve might consider a rate cut in their upcoming July or September meetings, which could further influence mortgage rates and housing affordability.

Current Events and Economic Factors

Several current events and economic factors are influencing the Bay Area housing market:

Federal Reserve Rate Decisions: The potential for a rate cut by the Federal Reserve in July or September looms large. This decision is contingent on further economic data, including inflation trends and consumer spending. A rate cut could lower borrowing costs and stimulate more housing activity.

Inflation and Consumer Spending: The recent inflation data and softer retail sales indicate a cooling economy. Retail sales in April were flat month-over-month and rose by only 3.0% year-over-year, falling short of expectations. High interest rates and inflation are beginning to curb consumer spending, which could impact housing demand.

Tech Industry Performance: The tech sector, a significant driver of the Bay Area economy, has seen mixed performance. While some companies continue to thrive, others are experiencing layoffs and restructuring. These dynamics can influence housing demand, especially in tech-heavy areas like Santa Clara and San Mateo.