Do people still care about winter real estate prices? Well, the data shows that people do, as evidenced by the fact that you are also reading this post. Let’s dive into the numbers.

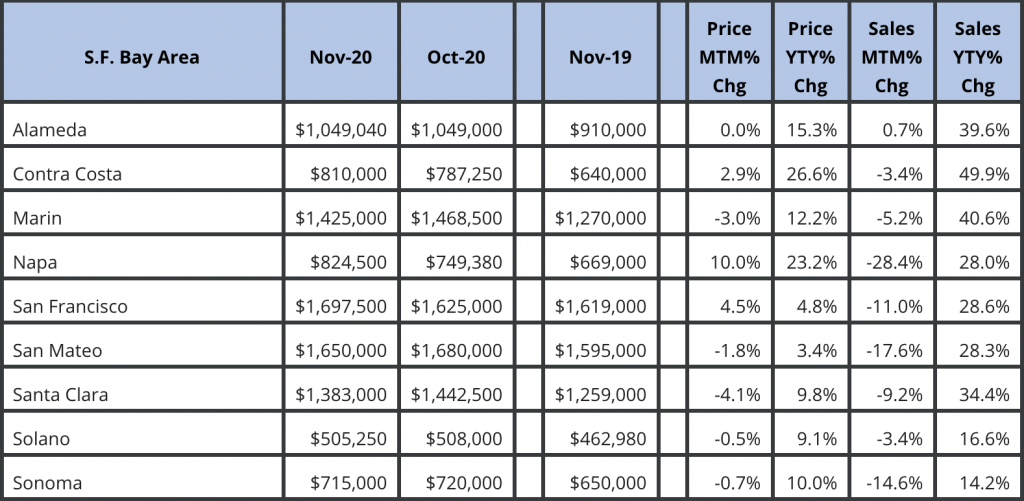

Various markets’ prices are holding up from October, while most markets saw a drop in sales quantity. This is a sign of seller retreat rather than a surge in buyer demand. Given most markets saw anywhere between 28% to 50% year-over-year increase in quantity, the habitual lack of supply in winter is finally not keeping up with the demand. One may see this as a leading indicator of home prices in the months ahead.

In our local Emeryville market, specifically the Bridgewater condominium, because the building has a close to 50% tenant occupied ratio, prices are still depressed due to investor exiting the rental market. On the other hand, we don’t see much sell-off by owner-occupied. This is a short term pain units owners need to endure; in the long term, having a higher owner-occupied ratio is more healthy for the community and will benefit the home values in the long term.