As the cooler weather sets in, the Bay Area’s real estate market is heating up with a mix of shifting rates, increasing inventory, and eager buyers making moves. With the Federal Reserve’s recent interest rate cuts and more homes hitting the market, both buyers and sellers are adjusting their strategies.

Here’s what you need to know about how these trends are impacting Emeryville and the surrounding Bay Area this month.

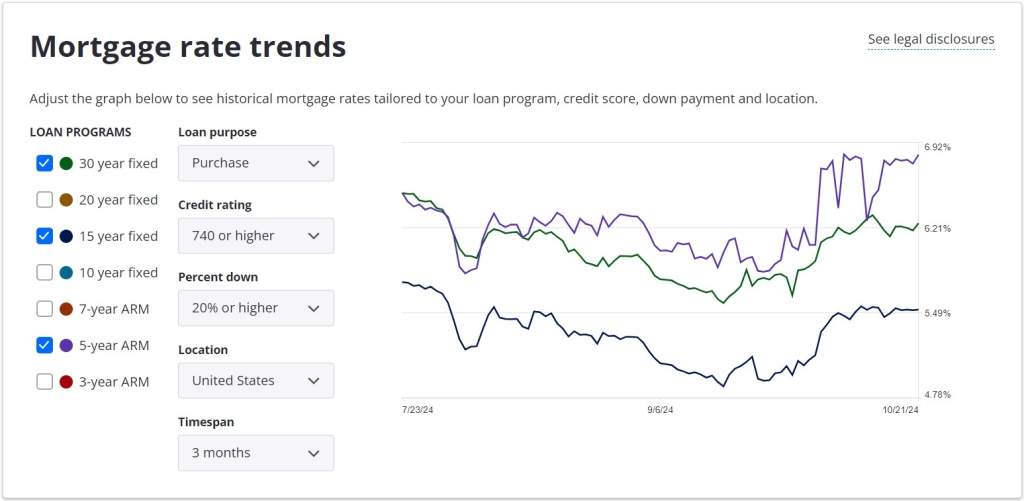

Inflation Cools, But Mortgage Rates Hold Steady

Inflation is finally easing, with the headline Consumer Price Index (CPI) dropping to 2.4% in September, the lowest in nearly four years. This progress aligns with the Fed’s plan for a “soft landing,” meaning the economy could stabilize without triggering a recession. However, a surprisingly strong jobs report this month has kept mortgage rates elevated at around 6.6% for a 30-year fixed-rate loan.

While rates haven’t dropped as quickly as hoped, they’re still significantly lower than last year’s peaks. For buyers in Emeryville, this means potential savings over time as more rate cuts are expected later this year. If you’re considering a home purchase, it might be smart to start exploring your options now before competition ramps up.

More Homes, More Choices in Emeryville

Despite the typical fall slowdown, new listings across the Bay Area are up. In Emeryville and neighboring areas, inventory has risen, especially among homes priced between $400,000 and $800,000, ideal for first-time buyers or those looking for affordable options. This surge in listings means less competition for buyers, giving them more negotiating power than in the frenzied market of 2022.

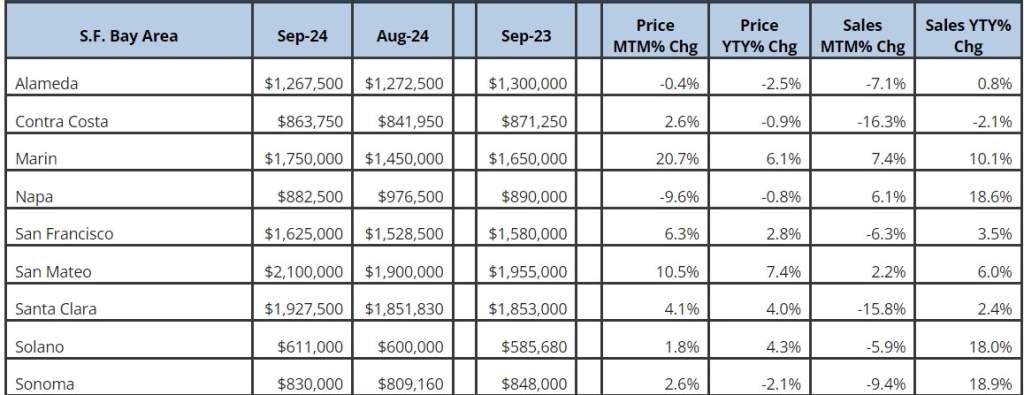

Across the region, sales trends vary by county. Marin County saw a notable 20.7% jump in home prices from August to September, while Napa County experienced a 9.6% drop. In Alameda County, where Emeryville is located, home prices slipped by 0.4% from August but remain only slightly below last year’s levels. Meanwhile, sales fell by 7.1% month-over-month as many buyers took a “wait-and-see” approach.

Here’s how prices and sales changed across Bay Area counties in September:

More Homeowners Tapping Into Equity

With home values remaining steady, more homeowners are using their equity to fund renovations, pay off debt, or make other investments. According to CoreLogic, home equity loans are being issued at rates not seen since 2008. In cities like Oakland, San Jose, and Emeryville, tapping into equity has become a popular choice as people look to maximize their assets in a changing market. If you’re considering this route, now might be the right time before rates start to shift again.

What This Means for Emeryville Buyers and Sellers

For buyers, more homes on the market mean more choices and room to negotiate. Whether you’re looking for a cozy condo or a family-friendly townhome in Emeryville, this could be your moment to lock in a better deal before rates adjust further. Sellers, on the other hand, need to focus on competitive pricing and curb appeal to attract buyers who now have more options.

Conclusion: Your Next Move in Emeryville’s Real Estate Market

Emeryville’s market is evolving, with increased inventory, easing inflation, and anticipated rate cuts shaping the landscape. Whether you’re buying, selling, or thinking of tapping into your home’s equity, understanding these trends can help you make informed decisions.

At The Cal Agents, we’re here to guide you every step of the way, helping you find the best opportunities in this changing market. Let’s talk today about your real estate goals.