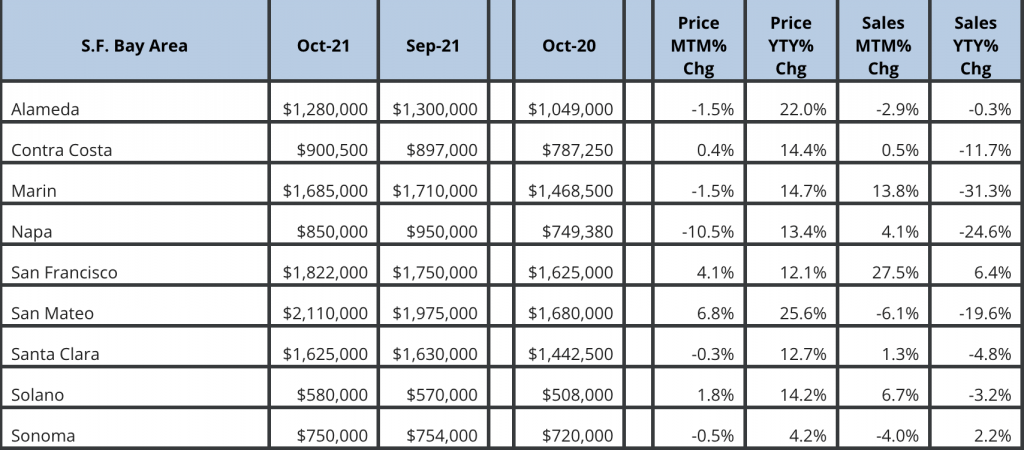

We are now in the midst of the holiday season! As we are getting closer to Christmas and the New Year, we are seeing the typical cool-off in the real estate market. Let’s take a look at October’s sales statistics and the most up to date mortgage rates.

Alameda, Marin and Napa counties are leading the pack in the transition to winter real estate, recording a moderate withdraw from high prices. Napa county showed a 10.5% drop in median sold home prices. Before you panic and rush to list your Napa home for sale, it’s beneficial to understand that Napa’s prices have always been more volatile than others due to its small number of transactions per month. Alameda and Marin county’s minimal withdrawal can simply be classified as the market staying flat.

San Francisco county is recording a nice 4.1% gain month over month, reflecting the fact that people are starting to move (if not flock) back to the city. The most affluent county in the Bay Area, San Mateo, is recording a 6.8% month over month gain and a jaw-dropping 25.6% gain compared to the previous year. The rich just gets richer.

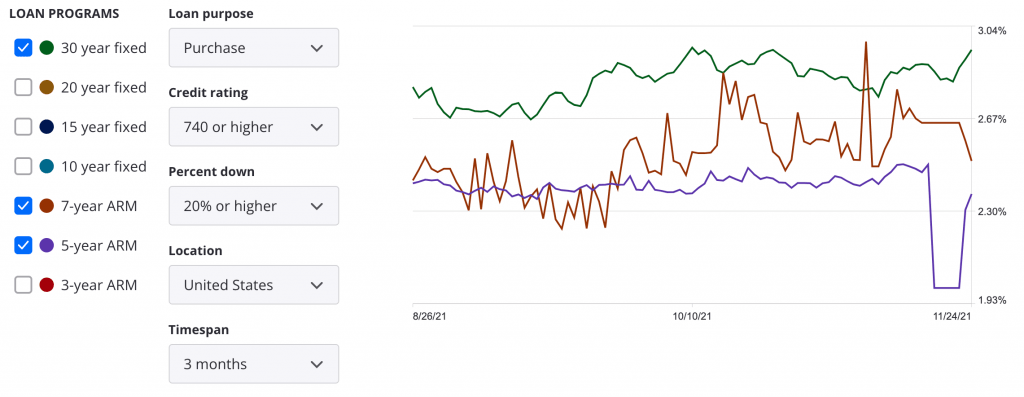

Home prices alone can’t tell the whole story. Whenever I find the home prices absurdly high, I always like to go to the affordability index to see how home prices compare to the income and mortgage interest rates. Despite ever-s0-high home prices, there are around 20% of home buyers who can still afford to buy in most counties. Compare that to only 10% homebuyers could afford to buy at the brink of the crash in 2007, there is still affordability room. This room, however, can be eroded by the upswing in mortgage interest rates in 2022.