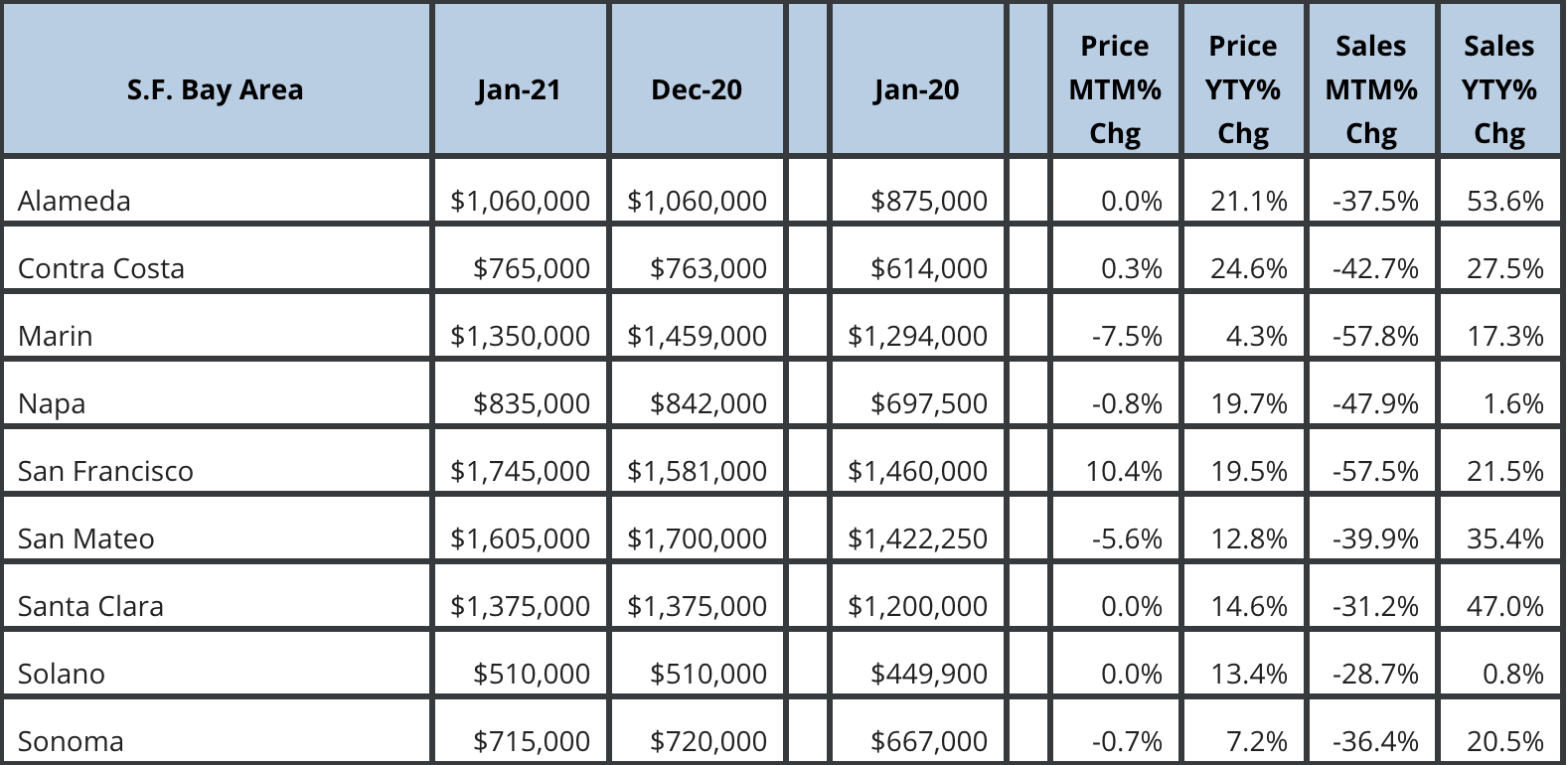

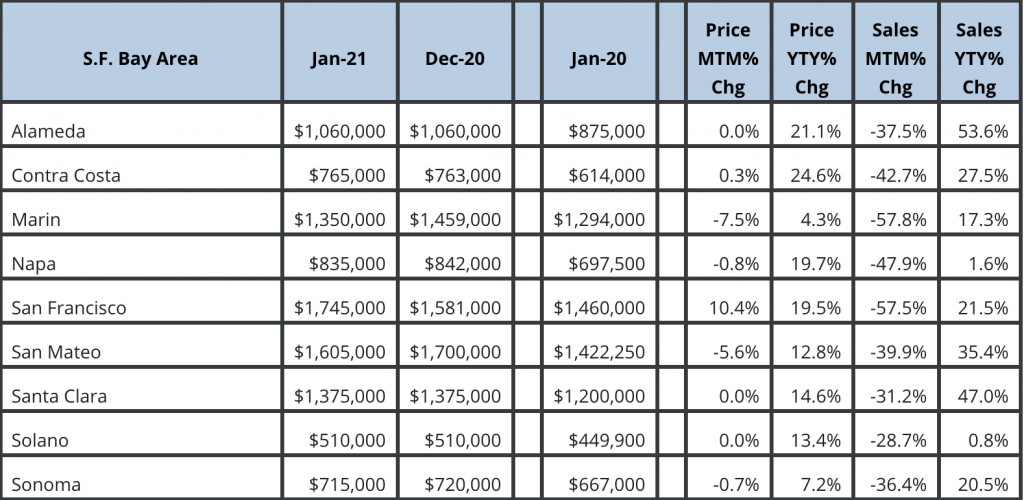

It’s the time of year when everyone is looking for some housing market prediction of 2021. Instead of the monthly market update, I’m throwing the boring numbers aside and want to write about my 2021 real estate market prediction. If you are so addicted to monthly number, you can still find the January sales number at the bottom of this post.

Many Realtors like to draw from recent market experience and tell you what the market has been like and try to irresponsibly extend shot term phenomenon to a year-long prediction. Some smarter Realtors use market sentiment like the infographic below as a leading indicator of where the market will go. After all, the market is consisted of buyers and sellers and their sentiment drive their decisions and actions, which move the market. This is all true and well, but only in a traditional market. I argue that there is a greater force than supply and demand that is driving the market now and will continue to do so in through out 2021.

Rather than predicting the market with “up” or “down”, I think it’s more informative for my audience to understand the underlying forces and arrive at the answer themselves.

The “Greater Force”

Ever since COVID hit on March 17th, the Treasury has been printing money like crazy for the Fed to purchase asset. You can check out this famous chart from the Fed’s balance sheet.

The money the Fed used to buy the federal bonds flowed back into the market and freed up all investor’s capital which used to be in bonds. This capital has been looking for a place to call home ever since. Throughout 2020, it found its way into the stock market. In the 2nd half of 2020, it found its way into real estate, more notably single family homes. At the end of 2020, it flowed into to BitCoin. Basically, anything that has a descent prospect in appreciation has attracted this gigantic amount of capital. When there was demand, all these assets value went up. And there will continue to be demand as long as Treasury and Fed keeps pumping cash into the market. This is the force of currency devaluation, which is a greater force than both supply and demand because it affects both buyers and sellers. Buyers know if they don’t buy something, their cash will devalue; sellers know if they sell their assets, the cash they get in exchange will devalue. This “greater force” artificially drives up demand and squeezes supply. Inevitably, the market will continue to go up until the Fed stops purchasing federal government bonds.

The money the Fed used to buy the federal bonds flowed back into the market and freed up all investor’s capital which used to be in bonds. This capital has been looking for a place to call home ever since. Throughout 2020, it found its way into the stock market. In the 2nd half of 2020, it found its way into real estate, more notably single family homes. At the end of 2020, it flowed into to BitCoin. Basically, anything that has a descent prospect in appreciation has attracted this gigantic amount of capital. When there was demand, all these assets value went up. And there will continue to be demand as long as Treasury and Fed keeps pumping cash into the market. This is the force of currency devaluation, which is a greater force than both supply and demand because it affects both buyers and sellers. Buyers know if they don’t buy something, their cash will devalue; sellers know if they sell their assets, the cash they get in exchange will devalue. This “greater force” artificially drives up demand and squeezes supply. Inevitably, the market will continue to go up until the Fed stops purchasing federal government bonds.

Bubble Bursting Concern

“Does the Fed worry about the bubble burst?” Historically, the Fed has been commissioned to control inflation and achieve full employment. Asset prices, asset bubble, asset bubble bursting are not the Fed’s primary concern. Of course, if it’s up to the Fed, they’d much prefer the bubble deflate in an orderly fashion and everything goes back to normal, knowing a burst of asset bubble will send many companies in main street and wall street into chaos. There is another school of economist who maintain the asset prices bursting has a bigger impact on the rich than average American and therefore it’s quite acceptable for the bubble to burst. That’s like saying “Investment always comes with risk. Bubble bursting is just part of normal investment cycle. If you can’t handle it, you really shouldn’t be investing.” Operating under this school of thoughts, the Fed so far has shown no fear of asset bubble or its burst. Bubble bursting is only a natural market self-correction.

As a side topic, if history provides any guidance, the US government has a long history of stepping in to save the economy at every burst in the last few decades. That lead me to belief there will be another round of big stimulus should the bubble burst again.

Conclusion

As long as you keep an eye on the Fed’s balance sheet, you will know when the Fed stops buying bonds and that’s when the demand of asset will retreat, causing downward pressure in asset prices. Whether the bubble will deflate in orderly fashion or burst largely depends on the Fed’s policy actions and external events like natural disaster, diseases, geopolitical conflicts etc. The former is controlled by the Fed but the later is a wildcard. There is where the uncertainty of feature truly lies.

Throughout 2021, the Fed will continue to purchase bonds and until the economy reaches full employment.. According to US Bureau of Labor and Statistics and Statistics, January unemployment rate is at 6.3%, which is May 2014’s level. There is no consensus of what is the unemployment rate at “full employment”. OCED estimated it to be 4% to 6.4%. For our purpose here, let’s take the mid point of that range, which results in 5.2%. If you refer back to the BLS website, the economy reached 5.1% unemployment in April 2015, which was 11 months after May 2014. Therefore, it’s not an unreasonable to expect the economy to follow the same path between 2014 and 2015 and will reach 5.1% unemployment by the end of 2021.

I expect the housing prices to continue strong in 2021 and may moderate in 2022 and see correction in 2023.