California has officially re-opened! We saw a lot of ups and downs this past year and the housing market was no different. Now that it is summer time, are you staying in town to shop for a new house or joining the crowd for some “revenge travel”?

For those of you who chose to stay in town to shop for your next property, I think it’s critical to remind everyone of the common real estate agent practice of “purposely under pricing homes”. If you have been in the market for a while, you should already know what I’m referring to. If you haven’t been in the real estate market for the last 6 years, the list price you see HAS NO BEARING on what the seller expects to get in today’s market.

For example, when we list a home for our sellers, we follow the same pattern. If our clients expect to get $1 million and sold neighborhood comparables support this, then we will probably list their property at $850,000.

Here are the statistics of the percentage of homes sold above ask price by different counties.

This chart is an indirect indication of how bullish real estate agents are across various counties. The more bullish the agents, the more they under list the asking price. Unsurprisingly, Alameda, Contra Costa and Santa Clara counties secured the top 3 spots. However, if you pay attention to the actual numbers, over 85% of counties have over 40% of their listings sold above ask price. This reflects the overall market sentiments.

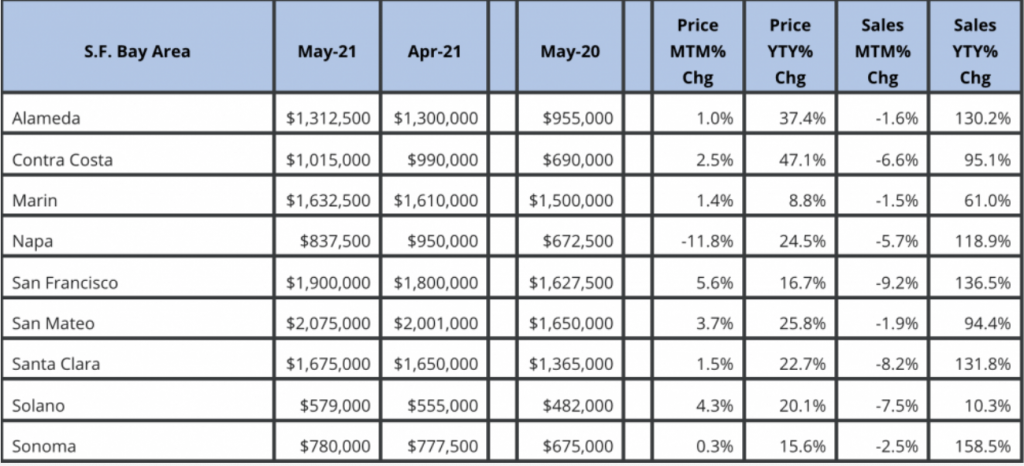

Now, let’s come back to the May’s statistics. Generally speaking, the price growth seems to have decelerated compared to those back in April. Coupling with the fact that the Sales MTM% change are all negatives, the number of sales went down compared to April. Does that mean that buyers are retreating from historical high home prices in the Bay Area? It’s too early to tell.

May is typically a hot month for real estate market. However, Californians got a taste of seeing the light at the end of the “stay-at-home” tunnel. And, because of that, a good number of our clients actually paused their home search and went to Hawaii instead. We anticipate the number of buyers this summer to be significantly smaller than Spring time. This “revenge travel” effect will be more noticeable in the mid-to-high price segment, putting pressure on price growth. Conversely, the lower price point segment will be relatively unaffected.