The first day of the summer solstice for this year will be on Sunday 6/20, which happens to coincide with Father’s Day. As we approach the official summer date, here’s how the Bay Area housing market is looking.

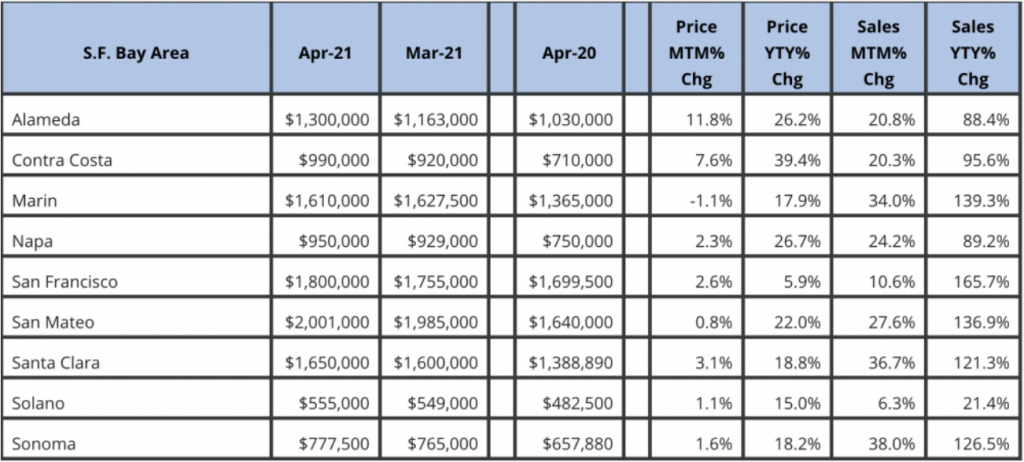

As prices continue to climb 10%, 20% and even 30% year over year, many of you may wonder if the housing market is ticking timebomb like in 2006. My take on this is, no it’s not.

First-time homebuyers in today’s market have more skin in the game

Compared to 2007-2008 housing bubble, the buyers in todays’ market are putting down a bigger percentage of down payment. The median down payment is at 10% in 2020 compared to 2.4% in 2006.

Only 4% of buyers have a second mortgage compared to 62.8% in 2006.

Only 4% of buyers have a second mortgage compared to 62.8% in 2006.

Only 2.3% of buyers used an adjustable rate mortgage compared to 38.1% in 2006. That means buyers in 2020 are much less likely to experience a payment shock than those back in 2006. If they can afford a mortgage today, as long as they can stay employed, they will continue to be able to afford the mortgage since the monthly payments are fixed.

40.9% of buyers bought with 0% down payment back in 2006. These buyers only constitutes 5.5% of today’s buyer pool.

Foreclosure wave probably won’t materialize

The vast majority of homeowners who got into mortgage forbearance are getting out with some plans to pay the mortgage going forward. As the chart below shows, 28.% never missed a payment since 6/2020, 25.5% added a few months of payment into the loan balance and stretch it out over the years, 15.4% paid it back in lump sum. Only 13.8% are delinquent without a plan. This is relatively small percentage. Consider today’s hot market, I bet a vast majority of these owners can sell their homes and walk away with a big fat check and just rent a home going forward. The impact of COVID related foreclosure will be negligible in the current housing market.

For the two reasons above, we can almost take out the foreclosure element in the next housing price correction. So what elements will likely to trigger the next housing price adjustments. I predict it will most likely come from weaken demand as California’s population growth comes to a stop, or even an drop. Population factor is hardly a shock to the market because it’s a graduate process. As demand weakens, prices may come to a halt or even moderate decrease. On the supply side, as long as unemployment stays at a healthy level, the home buyers today will continue to pay their low mortgage payments and thus have little pressure to sell. These supply-demand factors together lead me to believe the likelihood of big housing price adjustment is very low. Will there be price adjustment, certainly. Will it be a big drop? it’s very unlikely.