Discover the latest real estate insights straight from the heart of the Bay Area! Join us as our CEO and Founder, Lex Shan dives into October’s Bay Area home prices, mortgage rates, and more. Get ready to stay ahead in the ever-evolving San Francisco Bay Area Real Estate world 🌎

Real Estate Market Insight – October 2023 Data

As APEC closes its curtain, the real estate market undergoes a nuanced transformation influenced by a delicate interplay of economic indicators and geopolitical variables. The landscape, characterized by a delicate equilibrium, holds promise for prospective homebuyers and sellers, yet caution is advised as several factors loom on the horizon.

1. Mortgage Interest Rates Stabilize: The decision by the Federal Reserve to halt rate hikes for two consecutive meetings has become a cornerstone of market sentiment. The resulting stabilization in mortgage interest rates brings a breath of relief, particularly in the context of reduced inflationary pressures. This pause in rate hikes is not merely a momentary respite; it sets the stage for a potential shift towards lower rates in 2024, a prospect eagerly awaited by market participants.

2. Lower Interest Rates Reignite Buyer Activity: The stability in interest rates has acted as a catalyst, rekindling the interest of potential buyers. Eager to capitalize on the perceived affordability, buyers are once again exploring housing options. This surge in activity injects a renewed sense of dynamism into the real estate sector, fostering an environment where transactions are more likely to materialize.

3. Potential for Housing Market Recovery in 2024: Looking forward, the trajectory of declining mortgage rates into 2024 holds the promise of a robust recovery for the housing market. Beyond mere recovery, there is optimism that the market may reach unprecedented heights. Historical data underscores the correlation between lower interest rates, increased home sales, and augmented property values, painting a positive picture for both buyers and sellers.

Potential Disruptors to Interest Rate Trajectory:

- China’s Reduction in US Treasury Holdings: The global economic chessboard introduces a critical variable in the form of China’s strategic reduction in US Treasury holdings. As the de-dollarization trend gains momentum, the resultant decrease in demand for US treasury bonds could trigger a chain reaction. Lower demand translates to lower bond prices and, inevitably, higher interest rates. This development is being closely monitored as its ripple effects could reverberate through various sectors, including real estate.

- Bipolarization of US Congress as a Wild Card: The ideological fault lines within the US Congress present a wildcard element that could unpredictably sway the interest rate trajectory. The specter of a US default on its debt obligations, a consequence of the ongoing political discord, looms ominously. Such an event has the potential to expedite the de-dollarization trend, further exerting upward pressure on US interest rates. Real estate stakeholders must navigate these political uncertainties with a keen eye on potential consequences.

Conclusions:

While the current stability in mortgage rates elicits optimism, prudence dictates a cautious approach. The real estate market stands at the intersection of promising opportunities and potential challenges. Prospective buyers are encouraged to capitalize on the favorable conditions, recognizing that the window of historically low-interest rates may be finite.

Simultaneously, industry players must remain vigilant, understanding that the geopolitical landscape can introduce volatility. The intricacies of global economic shifts and domestic political dynamics necessitate a comprehensive risk assessment. Strategies incorporating flexibility and adaptability will be crucial to effectively navigate the evolving market conditions.

In conclusion, the real estate market at the end of 2023 and the beginning of 2024 is a landscape of possibilities with the potential for growth and resurgence. However, stakeholders must remain cognizant of the external factors that could alter this trajectory. As they tread cautiously, informed decision-making will be the cornerstone of success in an environment where both opportunities and risks abound.

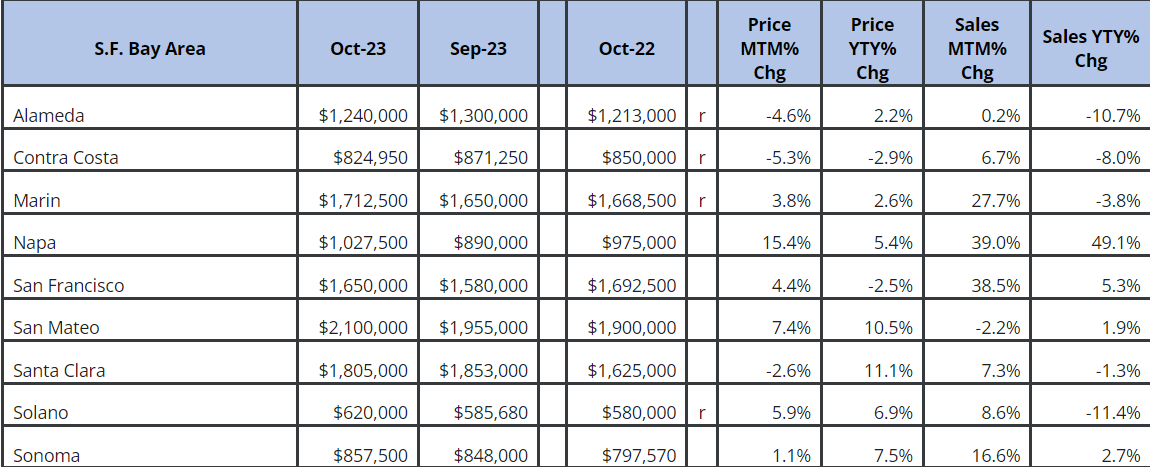

Here is the key information for October 2023.

If you wish to consult with one of our real estate experts, click the link below. Consultations can be in person, via Zoom, or over the phone.