Despite concerns of a sluggish economic growth forecast for 2023, last week’s economic data indicates that the U.S. has consistently outperformed expectations. The robust economy has put upward pressure on mortgage rates, but the average 30-year fixed-rate mortgage remains below 7%, supporting the housing market’s thaw. Pending sales have risen for the first time since early 2021, but California’s market is turning competitive again due to a lack of supply response.

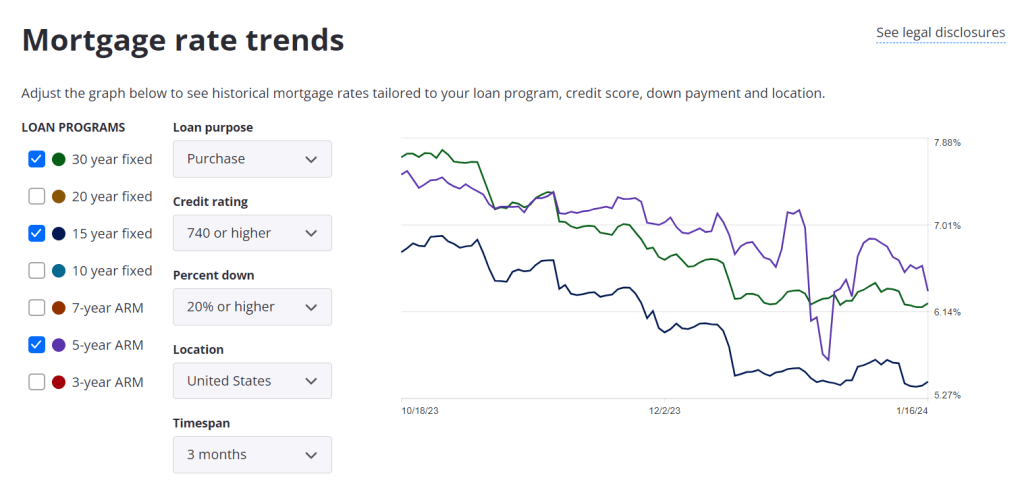

Mortgage Rates Hold Below 7%

Despite a positive GDP report showing a 3.3% expansion at the end of 2023, mortgage rates continue to stay below 7%. This trend, starting in December after the Federal Reserve’s meeting, is expected to persist as inflation decreases. The anticipation of the Fed cutting the Fed Funds Rate later this year may further boost home sales in the upcoming spring and summer months, gradually alleviating the “lock-in” effect for homeowners with historically low rates.

Year-to-Year Rise in Pending Sales

After a dip in existing single-family transactions in December, pending home sales in California have increased on a year-to-year basis, marking the first positive movement since spring 2021. The recent drop in 30-year fixed-rate mortgages has prompted buyers to re-enter the market, but low new listings and heightened demand are creating a more competitive environment. Active listings with reduced prices have decreased for the 8th consecutive week, pointing towards a potential 7th consecutive increase in median prices.

Shift in Mortgage Rates for Sellers

The National Mortgage Database indicates a decline in the percentage of Californians with interest rates below 4% for the 6th consecutive quarter, while those with rates at 5% or higher have increased for the 6th quarter in a row. Despite a lower transaction volume, recent sales have brought more homeowners closer to current market rates, potentially easing housing inventory concerns as the spring homebuying season approaches.

Resilient Economy Amidst Consumer Debt

Despite dwindling savings rates and record-high credit card debt, consumers have been the primary driver of economic growth since the reopening of the economy. Last quarter’s 3.3% increase across all economic segments was largely fueled by consumer spending. While the economy saw improvements in the trade balance and government spending, rising credit card debt suggests a potential slowdown in consumer spending. Paradoxically, this could provide room for the Federal Reserve to lower rates, benefiting housing supply and demand.

Recovery in New Home Sales

After a 9% drop in November, new home sales rebounded with an 8% increase, nearly offsetting the previous month’s decline. With existing housing stock remaining tight, home builders are capitalizing on reduced mortgage rates, enticing more buyers back into the market. Although California’s new home sales might not lead the way due to a depressed single-family construction sector, the persistent demand signals hope for increased construction projects nationwide, contributing to much-needed housing supply.

Looking forward

The home prices in the Bay Area will largely depend on the psychology between buyers (aka demand) and sellers (aka supply). With both groups foreseeing a drop in mortgage rates, buyer who have been waiting for the mortgage rates to drop will take the incoming rate drop as a sign of home prices going up, and therefore they will be more eager to buy now. Afterall, you can always refinance your mortgage at a lower rate in the future. On the other hand, sellers who have been holding out because of the recent drop in home prices will tend to hold out for a little longer so their homes can command a higher price when the mortgage rates actually drop. The home buyer season in Spring 2024 is expected to be very hot with increase in both prices and transaction volumes.

If you wish to consult with one of our real estate experts, click the link below. Consultations can be in person, via Zoom, or over the phone.

Schedule Meeting