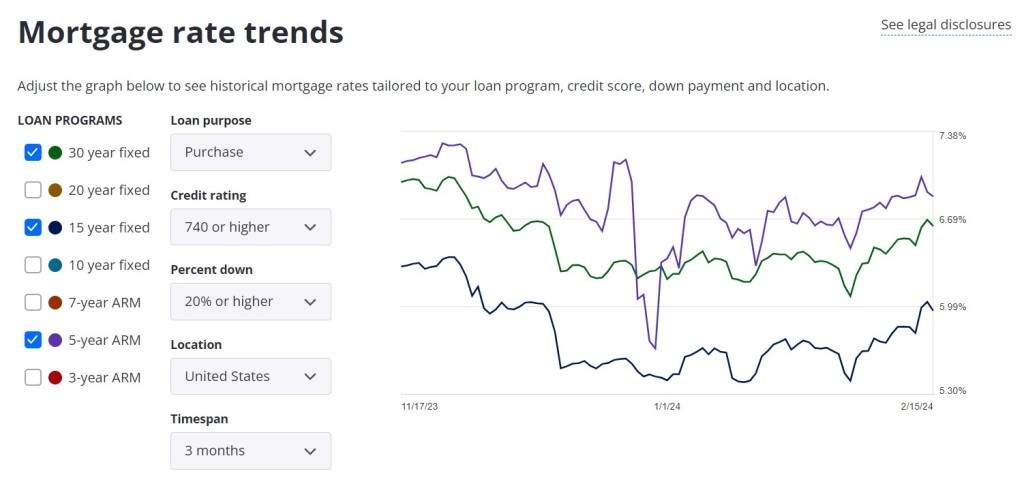

Following a notable rise in housing activity driven by lowered rates in January, the recent uptick back above 7% signals a fluctuating path to recovery, particularly as pending sales have tempered. Nonetheless, the prevailing indicators suggest that buyers are acclimating to a more typical rate environment post-pandemic, setting the stage for a lively Spring homebuying season. It’s important for buyers to balance short-term market concerns with the well-documented long-term benefits of homeownership.

Steady Momentum Despite Rate Fluctuations

In February, pending sales maintained a steady stance, retaining the momentum gained in January. This echoes a robust year-over-year surge, surpassing California’s closed sales performance last month. Notably, the luxury market, characterized by properties priced at $1 million and above, is witnessing a resurgence, with double-digit growth. This trend extends across various regions, including more urban and affordable metros, fostering a broad-based improvement. While rates did experience a reversal this month, recent trends indicate relative stability, albeit with some week-to-week volatility.

Rising Competition Signals Market Adaptation

Market competitiveness is on the rise, fueled by persistent inventory constraints. Consumers are swiftly adapting to prevailing rate conditions, reflected in heightened competition even before the traditional Spring buying frenzy begins. For instance, the median time homes spend on the market is declining, typically peaking in January and gradually decreasing throughout the busy season. This year, we’ve seen a notable drop, with the median time from listing to pending shrinking to just 20 days last week. Moreover, a growing proportion of homes are selling above their list price, indicating robust demand.

Promising Signs in New Home Sales

New home sales are showing promising signs, with active listings experiencing a modest decline on a year-over-year basis for ten consecutive months. However, the current month witnessed the smallest decrease, with new active listings marking their first annual increase in 19 months, signaling a potential shift in seller sentiment. Despite this positive development, some prospective sellers might adopt a wait-and-see approach amid concerns over recent rate fluctuations. Nevertheless, projections suggest a gradual improvement in inventory throughout the year.

Rate Trends: A Balancing Act

Regarding rates, there was a slight downturn last week, following a strong jobs report for January. However, there’s a noticeable variance between the Freddie Mac average and daily quoted rates, with the latter hovering above 7%. Given the latest economic data, a rapid decline in rates isn’t anticipated, with forecasts suggesting the Federal Reserve may delay rate cuts until the latter half of the year. Consequently, some homebuyers may seize current opportunities and consider refinancing later.

Understanding the Impact of Uncertainty

Uncertainty surrounding rate movements has undoubtedly tempered homebuyer demand despite the relatively robust economic backdrop. While rates have risen significantly over the past two years, resulting in reduced purchasing power, demand remains softer than expected. Notably, comparing the current situation to the aftermath of the 2010 financial crisis reveals a stark contrast in buyer activity, despite a stronger economy today.

Resilience in California’s Housing Fundamentals

Despite these challenges, California’s housing market fundamentals remain resilient. With a low delinquency rate of just 2.5% and nearly all homeowners possessing substantial equity, concerns about widespread distress sales are mitigated. Even in the event of a price correction, the vast majority of homeowners would retain positive equity, safeguarding against a surge in distressed sales during economic downturns. This underscores the underlying stability of California’s housing market amidst prevailing uncertainties.