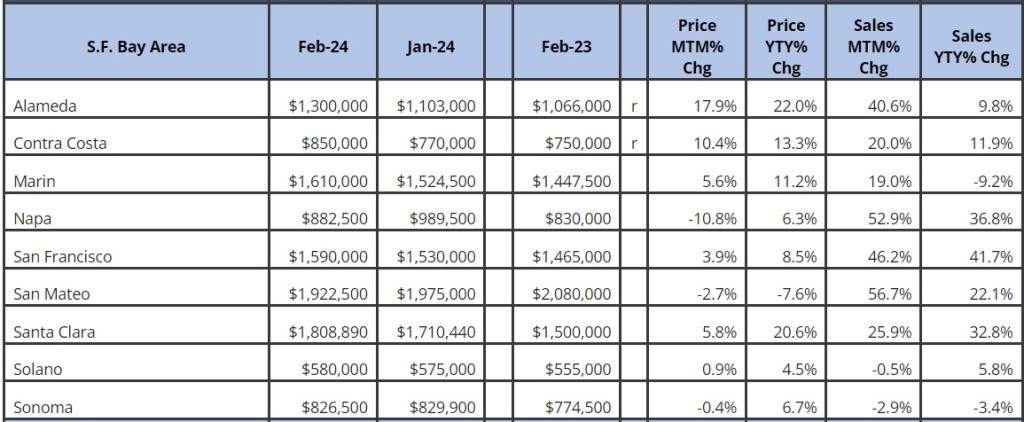

February Sales Surge Signals Hot Market Ahead

February’s closed sales painted a significantly more active picture compared to the same period in 2023. Across 7 out of 9 Bay Area counties, sales volume surged by over 20% compared to last year. Anticipation of lower mortgage rates in 2024, and consequently higher home prices, has buyers eager to enter the market. While this month’s numbers may be somewhat skewed by the unusually rainy January and February of 2023, which deterred buyers from touring homes, all indicators point to an even hotter market in Spring 2024.

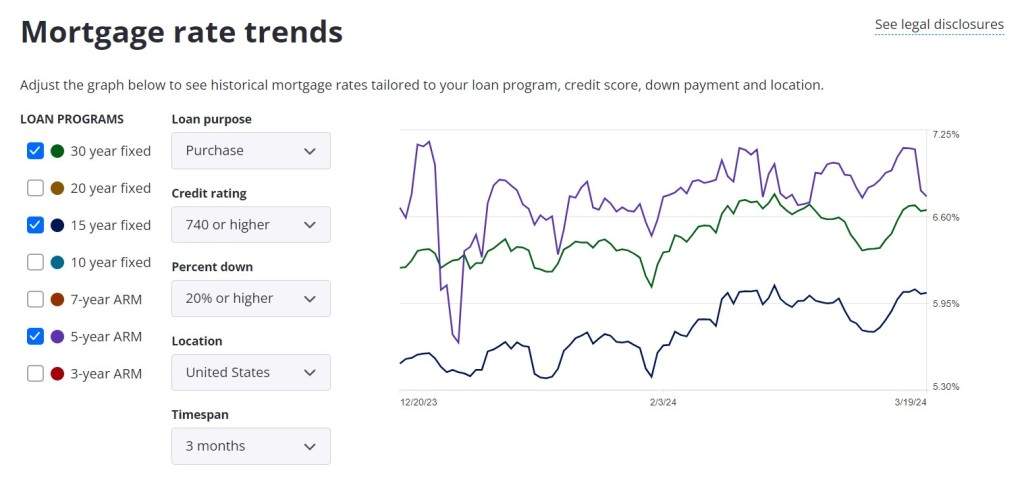

Fed Holds Rates Steady with Eyes on Future Cuts

Last week’s meeting of the Federal Open Market Committee (FOMC) resulted in the decision to maintain the federal funds rate at its current level. This move wasn’t unexpected, considering recent economic indicators signaling persistent inflation and overall economic strength. However, what caught the attention was the Fed’s reaffirmation of its plan to implement three rate cuts by the end of 2024, consistent with previous projections. This news, slightly more optimistic than market forecasts, led to an improvement in the bond market and a subsequent slight easing of mortgage rates.

Mortgage Activity Adjusts Post-Fed Announcement

Following the Fed’s announcement, the Mortgage Bankers Association’s Market Composite Index saw a 1.6% decrease in mortgage loan application volume for the week ending March 15, 2024. This adjustment reflects the market’s sensitivity to rate fluctuations, particularly in response to recent inflationary pressures pushing mortgage rates upward. Concerns surrounding the timing and extent of future rate cuts by the Fed contributed to mortgage rate volatility in recent weeks. However, with the Fed’s outlook in mind, mortgage rates are expected to trend downward, potentially stimulating mortgage activity in the coming weeks.

Positive Turn in Homebuilder Sentiment

Despite prevailing mortgage rate challenges, U.S. homebuilders are reporting increased confidence in their businesses, marking the first positive sentiment shift since July. Demand for new housing units remains robust, with the National Association of Home Builders/Well Fargo Housing Market Index climbing 3 points in March to reach 51. This marks the fourth consecutive monthly gain and the index’s highest level since July of the previous year. Builders are cautiously optimistic, relying less on price reductions and more on sales incentives like mortgage rate buydowns. Anticipated improvements in mortgage rates later in the year are expected to draw more buyers back into the market.

Strong Rebound in US Residential Construction

Mild weather and persisting inventory shortages fueled a significant rebound in U.S. residential construction, with housing starts climbing 10.7% month-over-month in February. This marked the highest monthly gain in nine months, offsetting the decline seen in January. The report from the US Census Bureau and the Department of Housing and Urban Development also revealed a positive outlook, with building permits increasing by 1.9% month-over-month to reach 1.518 million, the largest leap since August. With housing completions also on the rise, buyers can expect more options in the constrained market ahead.

California’s Labor Market Faces Challenges

While most states in the U.S. experienced solid employment growth in February, California faced some setbacks. The state saw a contraction in employment, ending a six-month streak of gains. The unemployment rate inched up to 5.3%, surpassing its pre-pandemic average. Industries like construction and trade/transportation experienced notable declines in employment, possibly influenced by weather conditions. Despite these challenges, the overall resilience of the labor market suggests potential for recovery in the months ahead.