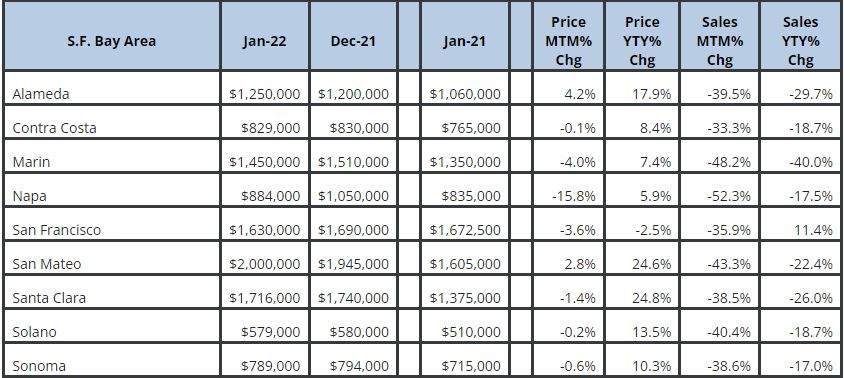

San Francisco Bay Area Market May 2022 Update

Let’s quickly go over April’s monthly data. Home prices continue to go up as the Spring real estate season kicks into full gear. San Mateo County, as usual, continues to lead the price scoreboard. On the other hand, Marin County had the highest percentage increase compared to the previous year. In the last month’s post, we explained that the effect of the interest rate jump will not show up in the market until a few months later. I expect prices will level off in June or July’s monthly sold data.

This month, I’ll turn our discussion slightly toward the rental market and investment property values.

Has Bay Area rent returned to pre COVID level yet?

A landlord client wrote to me and asked why her unit’s rent is still below pre-pandemic while she’s reading from many news outlets that rent has soared beyond pre-pandemic. The chart below is my study using rent data from Zillow Observed Rent Index. It shows that our 2022 April rent has reached a new historical height. Why isn’t this landlord’s unit still rented below pre-COVID rent? What’s going on?

First, from first-hand experience, many submarkets within San Francisco Bay Area are still lagging behind the national rent recovery. It’s officially the ONLY metropolitan area whose rent is yet to return to pre COVID level. The mystery lies in the wide gap between single-family home rent and apartment-condo rent.

To illustrate the difference, I chose to take a deeper dive into four zip codes’ data. These four zip codes are selected as representatives of a different part of the urban vs. suburban spectrum of housing.

Alameda

Alameda is a small island city east of San Francisco, primarily single-family homes. It’s chosen to symbolize the “ideal living” after COVID. When renting a single-family home, you have an excellent separation between neighbors, a nice backyard to enjoy California sunshine, and no elevator or laundry machines sharing. The chart below shows the rent for the Alameda lifestyle wasn’t impacted by COVID; it stayed flat in 2020 and trended upward in 2021. As of April 2022, the rent is 3% higher than the peak before the pandemic (the green line).

Emeryville

Emeryville is the first stop for San Francisco out-migrants as they cross the Bay Bridge to the East Bay. It’s the tech hub of the east bay. The rental housing consists of luxury apartments built after 2015, such as Avalon and EMME, and many more condos built in the 2000-2010 housing boom. According to the chart below, Emeryville rents dived in 2020 and bottomed out in Feb 2021. It has since bounced back to the pre-COVID level, only 2% below the March 2020 peak.

Oakland Adams Point

Oakland Adams Point

North of Lake Merritt is a neighborhood called Adams Point. It has easy access to the active lifestyle around the lake and all the job opportunities in downtown Oakland. Because Adams Point apartments and condos were built in 1960-1980, these units generally have larger living spaces than those made after (such as the Emeryville rentals). They are considered medium-grade rentals in a nice area despite the older finishes. Adams Point rentals are very much like the SOMA rentals; the rents are still 7% below the peak of April

San Francisco SOMA

South of Market (aka SOMA) is the hottest startup scene in San Francisco in the 2010-2020 era. It’s close to new tech jobs, local sports entertainment (SF Giant and Golden State Warriors), and trendy restaurants. It’s one of the hottest destinations the well-paid new workforce wants to live. Because virtually all tech companies closed their offices during the pandemic and people were working from home, many SOMA residents moved to more suburban areas for bigger indoor and outdoor spaces. SOMA’s rent was at 25% off (Feb 2021) from the peak and has now only recovered to 8% off the peak.

Conclusion

As you may conclude, it’s not enough to look at the overall San Francisco metropolitan data (as in the first chart of this article) to say that San Francisco metro rent has exceeded its pre-COVID level. The dataset can skew the overall numbers by significant single-family home rentals. When you zoom in to look at each neighborhood, you can see a considerable rent disparity.

Mortgage

30-year fixed mortgage interest briefly touched 5.30% in mid-May and has come down to 5.10%. The recent surge in interest rates represents a market panic. Now the market will take time to stabilize in this 5.00-5.40% range until the Fed further shrinks its balance sheet, at which point the rates will test another new height.

Oakland Adams Point

Oakland Adams Point

Join The Discussion